Empowering Underserved Commun

We are committed to developing inclusive solutions to address financial inequities within underserved populations, and to offering these products to those who need them most.

Driving Financial Wellness

MetLife’s Financial Wellness and Engagement group provides long-term solutions that bring financial wellness and education to individuals while strengthening our relationship with employers. This includes understanding the needs and financial behaviors of ethnically and racially diverse communities.

Learn more about our Financial Wellness products.

MetLife's Solutions

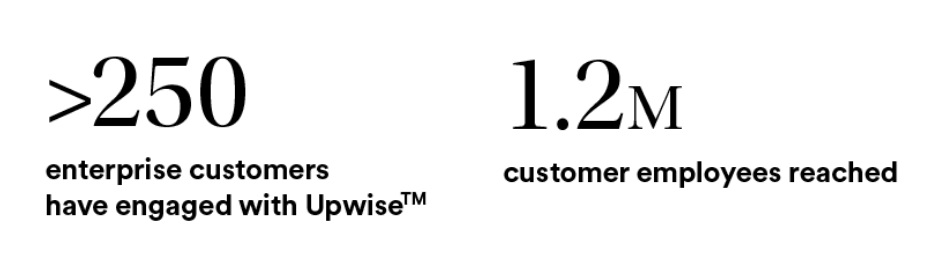

MetLife’s first-of-its-kind mobile app, Upwise™, is a free tool that can help consumers build positive financial habits and feel good about their progress. We presented Upwise™ on a broad scale in 2022. In addition, for public service employees using Upwise™, we worked with a company called Savi to provide a digital experience to assist with student loan programs. With Savi and Upwise™, borrowers who work for qualified nonprofit or public service organizations are provided access to tools to evaluate their eligibility and apply for Public Service Loan Forgiveness programs.

|

We are helping qualified borrowers take full advantage of the Public Service Loan Forgiveness program, navigating the

requirements that may cause them to think they do not qualify. In addition, we have published over 270 articles, including

more than 60 realted to DEI and seven related to climate change on UpwiseTM. Learn more.

MetLife’s 2022 Employee Benefit Trends Study identified financial concerns as the top contributor to low mental health among employees.1 Through our PlanSmart® program, a multi-channel experience that focuses on behavioral change, we offer tools and guidance that empower our customers’ employees to build financial literacy, confidence and well-being. PlanSmart® includes financial tools and financial education workshops offered by MetLife and provided by specially trained third-party financial professionals and administered via webinar or in person.2

Customers can schedule the webinars, which target early and mid-career employees and include topics such as the basics of investing, saving for retirement and tax strategies, at their convenience. Many webinars are tailored toward diverse audiences, and we encourage companies to host relevant sessions during DEI celebratory periods, such as “Women and Investing” during Women’s History Month, “Closing the Gap: Building Wealth in the Black Community” for Black History Month and “Planning with Pride: Financial Tips for the LGBTQ+ Community” through Pride month.

Now in its second year, the Mexico Private Sector Alliance to Promote Financial Inclusion is a program co-founded by MetLife Mexico and the UN Development Programme to develop collaborative business models to expand financial health and inclusion for underserved customer segments.

The alliance has recently focused on ways to boost digitization, partner with small- and medium-sized enterprises, and make financial services more accessible to women and to rural populations, both groups with traditionally less access to financial services. In the next year, it aims to implement at least two pilots to help establish business partnerships among participating companies.

Many of our products cater to low- and moderate-income families, helping protect them against death, sickness or disability.

In Nepal, MetLife began offering Rural Term Insurance plans to customers of local microfinance institutions and financial cooperatives. The plans are a combination of life and accident coverage with limited underwriting. MetLife Bangladesh introduced insurance kiosks across the country to engage customers and explain products and services.

With one of the world’s fastest-aging populations and a significant unmet demand for elderly care services, people in China are increasingly worried about life after retirement. In December, MetLife China became the first of our markets in Asia to launch 360Future, MetLife’s new retirement solution. 360Future combines retirement savings and insurance with health and wealth services to support customers and their elderly family members in retirement.

Product Offerings for Diverse Populations

MetLife provides solutions to support diverse employees from various backgrounds, along with accessible education and resources. We seek to understand the diversity of employees of our enterprise customers, using data to connect products and benefits usage, and offer products and plans to support inclusivity in three ways:

We have equipped our sales teams with information about our product capabilities that can help customers navigate the complexities of DEI in the benefits marketplace. For example, to raise awareness about services for LGBTQ+ families in our Legal Plan product, we have spotlighted product features such as domestic partner and same-sex spouse coverage, legal assistance for partner designation and estate planning to recognize same-sex partners.

We recently completed qualitative research with benefits representatives from 26 employers and nine brokers to obtain feedback on how DEI-specific features of our products are resonating with employers and their employees. Study participants believed the value proposition resonates well, feels relevant to various DEI populations and could be instrumental in enabling employers to achieve their DEI goals. We plan to conduct research among customer employees to augment the findings with insights from diverse employee populations.

Enhancing offerings for women

MetLife Mexico is developing a web platform that showcases our products with gender-related features. This platform called “Te quiero segura” is being developed with the support of the Financial Consumer Protection Agency (CONDUSEF) and the Women’s Institute (INMUJERES) and is expected to be launched in first-quarter 2023.

MetLife Brazil offers discounted group life insurance to companies with an employee base of at least 40% women and where women have an average salary greater than or equal to 90% of the average salary of men.

Connecting customers with diverse service providers

MetLife Legal Plans provide individuals with information and tools so they have the option to connect with attorneys who share their language, race and background. This helps reduce the psychological barriers to accessing legal support and enables relationships of greater trust between individuals and providers to drive better outcomes, so that our customers can navigate both exciting moments, like buying a home, or challenges, like getting a speeding ticket, with confidence and sound counsel.

MetLife Legal Plans has also introduced comprehensive and personalized caregiving solutions to help employee caregivers be better equipped to tackle burnout. Through a partnership with Family First, MetLife Legal Plans gives plan enrollees and their families ongoing access to expert care teams comprising professionally accredited nurses, Harvard-trained physicians, social workers and mental health professionals, backed by industry-leading artificial intelligence and an expert-authored and curated content library.

Up next: Supporting Our Customers’ Wellness

Continue ReadingMore from this chapter

Learn more about For Our Customers in the links below:

Explore additional chapters:

Want the full report?

Download for comprehensive insights and strategies.

1 20th Annual Employee Benefit Trends Study, 2022.

2 The financial professionals providing financial education are not affiliated with MetLife but are providing the program under a service provider contract.